WASHINGTON—Taxpayers are receiving significantly less of a bang for their buck from offshore oil development—even though energy companies have access to six times as many leases as they did in the early 1980s.

Statistics compiled by two researchers studying the last 30 years of leasing policy show that per-acre lease rates have plummeted almost nine-fold from shortly after the time Ronald Reagan assumed the presidency to the tail end of President George W. Bush’s second term.

An average of $2,224 per acre for all federal leases sold between 1954 and 1982 careened to $263 per acre for federal leases sold between 1983 and 2008.

And those eye-opening losses don’t even account for how inflation has eaten into the U.S. dollar during that time span.

The recent BP oil spill in the Gulf of Mexico has prompted the researchers who published these findings almost a year ago, to again ask why Congress and the Department of the Interior’s Minerals Management Service (MMS) have been so reluctant to update a leasing program severely altered in favor of the oil industry, first in the early 1980s by James Watt, Reagan’s secretary of Interior, and later again under President Clinton.

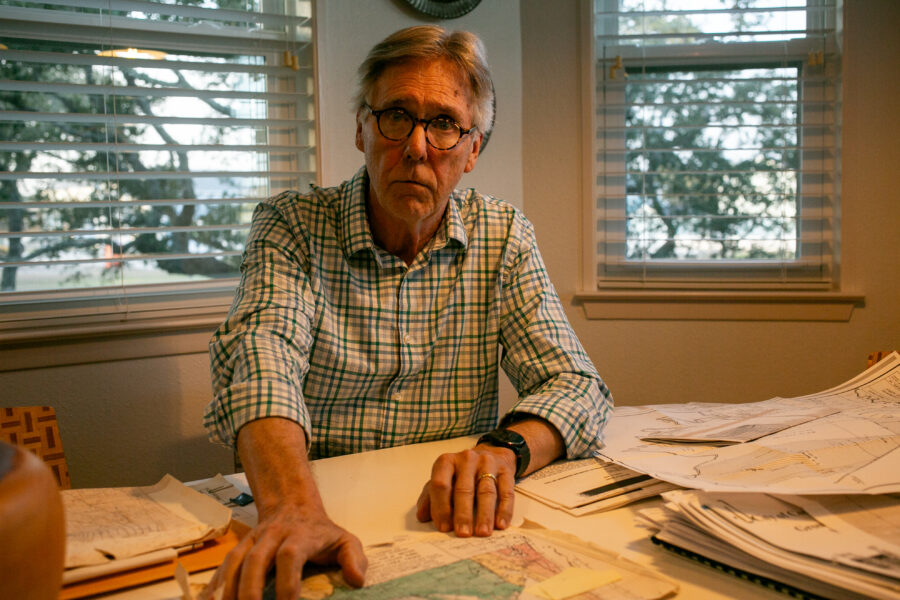

“It seems to be a good time to follow the money,” Bill Freudenburg, one of the researchers, told SolveClimate in a telephone interview this week.

Freudenburg, who teaches in the Environmental Studies Program at the University of California, Santa Barbara, undertook the research with Bob Gramling, a professor of sociology at the University of Louisiana, Lafayette. They initially published their findings in the online version of Miller-McCune magazine last June.

“Initially, back when we started our number-crunching, this didn’t look good for the taxpayer,” Freudenburg said. “But we were really surprised at how bad it looks for the taxpayer.”

The professors’ tracking showed that 3,520 leases were sold at the $2,224 average rate, while 21,179 were sold at the $263 rate. Their research didn’t include total number of acres sold.

The duo started studying offshore leasing of public land for energy exploration in the middle and late 1980s when Freudenburg served on the MMS’s scientific advisory committee and Gramling was chosen to be on a committee the first President Bush asked the National Academy of Sciences to set up to examine offshore leasing issues in Florida and California.

How Did It Reach This Point?

Legislation passed in the 1950s designated the Department of the Interior as the agency to manage U.S. offshore lands. Before MMS was created in the early 1980s, each offshore lease sale offered only a limited number of blocks within an offshore area, Freudenburg says. He adds that block selection was based on a U.S. Geological Survey resource assessment.

“Since then, the leasing process has continued to evolve, almost completely privatizing the exploration for and the development and production of offshore energy resources,” Freudenburg and Gramling wrote in their Miller-McCune article. “The government decides on the quantity of land to be leased and sets out royalty rates. Otherwise, however, energy companies hold most of the cards, deciding which tracts to bid on and explore based on survey information only available to the largest of those companies.”

Two major switches to offshore policy, Freudenburg says, enabled the move toward reduced competition and bargain prices for energy companies. One was Watt’s early 1980s policy change to what’s called “area-wide” leasing and the second was the 1995 Outer Continental Shelf Deep Water Royalty Act. More on those two game-changers a little later.

How the Government Gets Its Money

First, Freudenburg says, taxpayers need to understand the two primary ways the federal government “earns” revenue from offshore lands. Competitive bonus bids give companies the right to carry out oil and gas exploration, while royalties are a percentage of the value of the oil or gas actually extracted.

What’s known as a “government take” in the offshore leasing industry is a combination of those bonuses and royalties, plus rent, corporate income tax and special fees and taxes.

A May 2007 Government Accountability Office report concluded that the U.S. federal government receives one of the lowest government takes on the globe. Results from five private sector studies presented in 2006 show that the U.S. government receives a lower government take from the production of oil in the Gulf of Mexico than do states—such as Colorado, Wyoming, Texas, Oklahoma, California and Louisiana—and dozens of foreign governments, according to the GAO report.

“At a minimum, we need to be looking at rates being paid in the rest of the world,” says Freudenburg, citing Norway as an example where the government take is high and the drilling is competitive. “The sensible thing to do is to make our rates that high. Then, later on, when the oil companies get more desperate, we’ll get a higher income from it.”

Authors of the GAO report emphasized that the United States must continue to create a market that is competitive in attracting investment in oil and natural gas development.

“Such development, however, should not mean that the American people forgo a competitive and fair rate of return for the extraction and sale of these natural resources, especially in light of the current and long-range fiscal challenges facing our nation,” the report stated.

“The potential trade-offs between higher revenue collections and higher oil production highlight the broader challenge of striking a balance between meeting the nation’s increasing energy needs and ensuring a fair rate of return for the American people from oil production on federally leased lands and waters,” the authors continued.

Impact of Two Leasing Policy Game-Changers

Before 1983, the federal government would offer a limited number of “blocks” within an offshore area in each lease sale. Area-wide leasing, however, offered up all of a designated area such as the entire central Gulf of Mexico. The first area-wide sale offered up almost 38 million acres of ocean floor—shattering the block sale record of 2.8 million acres set in 1975.

“With entire areas being put up for sale every year, suddenly only the multinational oil companies had the economic resources to contract seismic surveys on most of those areas,” Freudenburg and Gramling wrote. “Area-wide leasing suppressed competition for offshore lands, allowing those in the know to offer minimal bids on promising blocks. More tracts were sold … with fewer bids per tract and at bargain-basement prices.”

Back in the early 1980s, Watt assured the public that area-wide environmental assessments and lease offerings of entire planning areas would encourage energy development, use tax dollars more efficiently and promote energy independence.

But Freudenburg and Gramling beg to differ.

“Area-wide leasing was a huge subsidy for major oil companies,” they agreed. “Whatever its other characteristics, what area-wide leasing seems to do best is to transfer huge swaths of public land into the hands of world’s largest oil companies at some of the world’s cheapest prices.”

Though 400 companies now own all or part of a federal offshore lease, Freudenberg says, only about 20 companies have more than half of those holdings.

And, they point out, this country now imports about twice as much oil as it did in the 1980s, partially because domestic oil production has fallen since then.

Before 1983, energy companies paid the federal government royalties amounting to one-sixth (about 17%) of the value of the oil or gas they actually extracted. With the onset of area-wide leasing, that royalty rate dropped to one-eighth (about 12.5 percent) of the resource value. The idea behind the decrease was to encourage exploration in the Gulf of Mexico’s deeper regions.

During the Clinton administration in 1995, Congress eased the royalty burden even further by passing the Outer Continental Shelf Deep Water Royalty Relief Act. It allowed companies to drill in certain areas without paying any royalties.

While royalties have risen slightly in the 21st century, Freudenburg and Gramling say those percentages need to be even higher to catch up with states such as Alaska and dozens of countries.

Easing the Deficit?

With the nation’s record-setting deficit at $1.55 trillion—and counting—Freudenburg wishes the government would see public land leases as a gap-tightener. Big picture arithmetic shows that such leasing by MMS is second only to the Internal Revenue Service in dollars destined for Uncle Sam.

“It’s a really distant second,” Freudenburg says. But at a time when this country is hurting from a litany of financial woes, “we need to treat this leasing program as a one-time bonus on a resource that we’re fortunate to have.”

“The 300 million-plus Americans are the ones who own this offshore oil source,” he continues. “It’s precious and there isn’t that much left. We could use the money to pay for schools, parklands and other necessities, instead of just saying nobody should make money off of this except for top executives of oil companies.”

(Photo: NOAA)

About This Story

Perhaps you noticed: This story, like all the news we publish, is free to read. That’s because Inside Climate News is a 501c3 nonprofit organization. We do not charge a subscription fee, lock our news behind a paywall, or clutter our website with ads. We make our news on climate and the environment freely available to you and anyone who wants it.

That’s not all. We also share our news for free with scores of other media organizations around the country. Many of them can’t afford to do environmental journalism of their own. We’ve built bureaus from coast to coast to report local stories, collaborate with local newsrooms and co-publish articles so that this vital work is shared as widely as possible.

Two of us launched ICN in 2007. Six years later we earned a Pulitzer Prize for National Reporting, and now we run the oldest and largest dedicated climate newsroom in the nation. We tell the story in all its complexity. We hold polluters accountable. We expose environmental injustice. We debunk misinformation. We scrutinize solutions and inspire action.

Donations from readers like you fund every aspect of what we do. If you don’t already, will you support our ongoing work, our reporting on the biggest crisis facing our planet, and help us reach even more readers in more places?

Please take a moment to make a tax-deductible donation. Every one of them makes a difference.

Thank you,