OKEECHOBEE, Fla.—If you want to get to know this hamlet sprinkled among ranchlands on the north side of Lake Okeechobee, one of the best people to talk to is its mayor, Dowling Watford.

Watford has lived here all his life. A self-described history buff, he can tell you how early in its existence Okeechobee was billed as the Chicago of the South, with ads appearing up north aiming to lure land investors. Instead the northerners flocked to Florida’s coasts, leaving this region relatively untouched by the explosive growth and development that have transformed much of the rest of the state.

“It’s kind of like a big family,” said Watford, an affable silver-haired man who drives a pickup truck and listens to country music. Before he retired he owned a Ford dealership. “If somebody is injured or something, if there is some need in the community, somebody will organize usually a barbeque dinner or lunch. Somebody will organize a fundraiser to meet that need, and it’s just amazing the charities, the support we get for any worthwhile cause.”

The region also is home to some of the highest insurance nonrenewal rates in the state, part of an overlooked epicenter of Florida’s insurance crisis, according to an Inside Climate News analysis of nonrenewal rates. The analysis is based on a national dataset the U.S. Senate Budget Committee released in December, along with academic studies of premium costs and the emergence in Florida of financially shaky insurance companies that are especially vulnerable to insolvency.

Nationwide homeowners such as those in bucolic Okeechobee increasingly are bearing the financial burden of escalating climate risk, which is exemplified by disasters such as this winter’s wildfires that engulfed Los Angeles and last fall’s Hurricane Helene, which carved out a vast swath of destruction from southwest Florida to western North Carolina. Greenhouse gas emissions, primarily those associated with fossil fuels, are heating the global climate, shifting weather patterns and leading to more extreme events such as wildfires and storms.

The risk is moving insurance companies to raise rates and withdraw from markets entirely. Hardest-hit is Florida, which is uniquely exposed to rising seas and more damaging hurricanes. Inside Climate News’ analysis reveals the homeowners who are most vulnerable to losing insurance are those with the least resources for dealing with disasters. These homeowners live dozens of miles from the coasts in the underserved agricultural communities of Florida’s heartland.

“The biggest burden is currently on homeowners who took out a mortgage five, 10, 15 years ago. They expect to pay a certain amount for their mortgage, and then all of a sudden the calculus on homeownership is flipped on them,” said Jeremy Porter, head of climate implications research at the First Street Foundation, a nonprofit organization researching climate risk. “So they’re trying to figure out how to stay in their home.”

In Florida, state attempts at helping these homeowners largely have fallen short. Leaders such as Gov. Ron DeSantis, a Republican, have dismissed the role of climate change in hurricanes and floods and done little to address the emissions exacerbating the problem or hold polluters accountable. The situation has left homeowners with little recourse as their insurance policies are cancelled or premiums soar. Some are working two jobs to afford the costs. Others are going without insurance entirely, putting these particularly vulnerable communities economically at even greater risk to the next disaster.

“We’ve got to do something for the average homeowner to be able to insure his home, and that’s where we’re not making progress,” Watford told Inside Climate News. “At some point we’re going to get to a breaking point.”

“Insurance Is a Major Topic”

Inside Climate News’ investigation focused on four counties around Lake Okeechobee, where nonrenewal rates were some of the highest in the state: Glades, Hendry, Highlands and Okeechobee.

Other counties affected by high nonrenewal rates included Franklin and Gulf, located in the Panhandle where 2018’s Hurricane Michael was the first category 5 hurricane to strike the continental U.S. since Andrew in 1992. Dixie and Levy, coastal counties situated in northwest Florida, weathered three hurricanes in 13 months: Idalia in 2023 and Debby and Helene in 2024.

In Okeechobee, Inside Climate News found that insurance is a major concern. Not only are there few policies to choose from, but the policies that are available often are unaffordable. The situation represents a significant economic issue, as most lenders require mortgage-holders to carry insurance. Residents without mortgages increasingly are going without insurance altogether.

“Insurance is a major topic,” said Monica Clark, who got so frustrated after receiving multiple cancellation letters from both private and Florida’s state-run insurer that she campaigned for the city commission and now is vice mayor.

Okeechobee, with a population of about 5,500, spans four square miles. Many residents commute to the coasts but live here, where life is more affordable and the pace more leisurely. The median household income in Okeechobee County is $52,288. In 2023 the nonrenewal rate was 8.3 percent, up 4,236 percent since 2018. In 2022, nearly a quarter the county’s policy holders received nonrenewal notices from their insurance companies, according to the Budget Committee data.

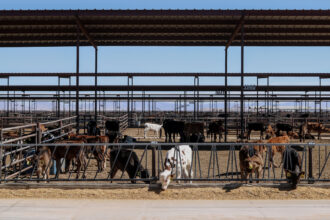

Near the center of town is Cattleman’s Square, celebrating Okeechobee’s ranching roots with statues depicting a cattle drive led by Pete Clemons, a well-known rancher, citrus grower and rodeo performer. A nearby arena features a few rodeos a year and hosts the state’s largest livestock market, with auctions Mondays and Tuesdays selling on average 1,200 head of cattle daily.

The town is popular among anglers because of its proximity to Lake Okeechobee, the state’s largest lake, and naturalists who come to experience the headwaters of the Everglades. A unique draw is the exceptionally dark nighttime sky over the Kissimmee Prairie Preserve State Park, which is known for an unusual lack of light pollution enabling the stars to shine exceptionally brightly here.

Despite being inland, the region has weathered its share of disasters. Last year Hurricane Milton spawned at least 45 tornadoes across central and south Florida, including one that hurled the trailer shared by Charlie Dahlonega and her husband, John Alberigi, through the air.

The couple was home at the time, and both were thrown from the trailer. Dahlonega suffered a skull fracture, and Alberigi, who has dementia, sustained multiple injuries to his arm and torso, including broken ribs. Their home was completely destroyed, and they did not have insurance because it was too expensive. Since then they have received some federal assistance, and community help has sustained them. Eventually Dahlonega plans to move out of the area with her husband.

“They make it impossible for some of us to afford insurance,” said Dahlonega, 70, a retired paralegal. “I just feel like I’m less cared for. It’s kind of like when your house is robbed. If you’re someone of note you get more attention from the police department. You just feel like you’ve been written off because you don’t have a big bank account.”

Insurance is supposed to be something you pay for and forget about, and it’s there if you need it. But in Okeechobee insurance is on people’s minds a lot. Here residents can tell you not only about their own insurance problems but those of family members and friends and neighbors and people they go to church with and people with whom they play golf.

Clark estimated she spends up to 20 percent of her time thinking about insurance. She lives with her husband in a 3,000-square-foot brick home built in 1988. She owns a family-run air conditioning business, and he retired earlier this year from a 45-year career in education, most recently as a guidance counselor at the local high school. Their four kids are grown.

She and her husband have received multiple cancellation letters through the years from both private insurers and Citizens Property Insurance Corporation, the state-backed insurer of last resort, leaving them scrambling from one policy to the next.

Meanwhile Clark’s nephew, a firefighter who lives in nearby Clewiston with his wife and two young sons, is working overtime to pay for their $16,000 policy. Her brother, who also lives in Clewiston, is going without insurance after receiving a renewal notice for $16,000. The median income in Hendry County, where Clewiston is located, is $53,044. In 2023 the nonrenewal rate was 7 percent, up 1,315 percent since 2018. In 2022 the nonrenewal rate was 23 percent.

“We are a rural community, and people work so hard for what they have and it’s just one more thing for them to fight for,” she said. “I know so many people working two jobs just to make ends meet.”

Watford, the mayor, is concerned for the local economy, as homeowners are left with less spending money for a night out or new car. But what he fears most is another disaster in a community where many people have no insurance. He worries about people moving out of the area, where would they go and what would that do to home values here.

“It’s going to put more burden on the government to provide either clean-up or provide services,” he said. “But in the long run, if someone’s home gets destroyed, are they going to move out of the area? Where are they going to live? What is that going to do to home values?”

Other States Aim to Hold Fossil Fuel Companies Accountable

Across Florida as many as 54 percent of homeowners are worried about how they will afford insurance because of climate change, according to a recent Florida Atlantic University survey. Average premiums rose by nearly 60 percent between 2015 and 2023, outpacing every other state, the survey said, citing a 2023 LexisNexis Risk Solutions report.

Legislative reforms in recent years aimed at addressing a tide of litigation against insurers have faced criticism from those who believe the reforms benefited the insurers more than homeowners. An estimated 47 percent of claims that closed in 2024 without payment resulted in a lawsuit, a 17 percent increase since 2022, before the reforms were implemented, according to an analysis released this month by Weiss Ratings, an independent insurance ratings company. The analysis was based on data from the National Association of Insurance Commissioners.

This story is funded by readers like you.

Our nonprofit newsroom provides award-winning climate coverage free of charge and advertising. We rely on donations from readers like you to keep going. Please donate now to support our work.

Donate NowThe data show the reforms did not work, said Martin Weiss, founder of Weiss Ratings. Instead the reforms emboldened insurance companies to deny more claims, generating more lawsuits, he said. He dismissed assertions that the lawsuits were frivolous.

“Why in the world would the people in Florida be 12 times more prone to filing frivolous lawsuits than the people in Georgia or New York or any of the other states?” he asked. “We’re not from Mars. We’re not monsters from Mars living in Florida. We’re just normal people trying to get money for our claims.”

But Chuck Nyce, a professor of risk management and insurance at Florida State University, said the reforms have helped attract new insurers to the state, boosting competition and stabilizing rates.

“I don’t think people realize how close we came to having a complete collapse of the private insurance market in Florida,” he said. “Companies don’t leave the state if they’re making money. Companies don’t go bankrupt if they’re making money. But they went bankrupt, and they were leaving.”

Homeowners can access funding for new roofs and other improvements to help lower insurance costs and harden their homes against hurricanes through the state’s My Safe Florida Home program. The program has provided millions of dollars for homeowners since it was created in 2006 but has struggled to meet demand, and legislative efforts to expand the program have failed. Funding also is available to help communities fortify their infrastructure under the $1.8 billion Resilient Florida program. Gov. Ron DeSantis, a Republican, implemented the program in 2021, and his administration has touted the program as a historic investment toward preparing communities for rising seas, more damaging storms and flooding.

Three years later the governor signed legislation to restructure Florida’s fossil-fuel based energy system that erased several instances of the words “climate change” from the state code. There is overwhelming scientific consensus that fossil fuel emissions are warming the planet. One recent study concluded it now is scientifically feasible to link individual emitters with specific harms, for the sake of litigation.

“Ultimately homeowners have to understand that there is someone to blame for the predicament that they are in, and that is the elected officials who deny the existence of climate change while taking massive financial contributions from the fossil fuel industry,” Sen. Sheldon Whitehouse (D-R.I.), former chairman of the U.S. Senate Budget Committee, told Inside Climate News. “It’s just going to keep getting worse as long as that industry-funded denial continues.”

In New York and Vermont leaders have approved legislation aimed at holding fossil fuel companies accountable for climate-related harms. The measures are based on the federal Superfund model, which requires polluters to pay for damages. The laws represent a growing momentum among states that are considering how the Superfund model may serve as a means of recovering costs associated with climate change. California, Maryland and Massachusetts are contemplating similar legislation. In Vermont the measure triggered a lawsuit from the American Petroleum Institute and U.S. Chamber of Commerce.

“It’s an obvious thought to go to the culpable parties to fund the clean-up and the recovery that is needed, not unlike a Superfund,” Whitehouse said.

In Florida there could be support for such a policy. The Florida Atlantic University survey found that 88 percent of residents agree climate change is happening, and 65 percent believe the state and federal governments should do more to address the impacts. The survey determined that 72 percent think the state should diversify its energy portfolio to include more renewable sources.

Communities where large numbers of residents have no insurance will struggle to recover from extreme weather events, Nyce said. Most homeowners lack the resources to rebuild without insurance. Some may relocate to smaller residences while others may abandon their communities entirely.

Watford, the mayor of Okeechobee, felt the Legislature could do more to help homeowners struggling with insurance problems.

“It would be helpful if we could have more competition so we could have a choice,” he said. “Usually when you renew you have to take what you can get because you feel lucky just to have insurance.”

About This Story

Perhaps you noticed: This story, like all the news we publish, is free to read. That’s because Inside Climate News is a 501c3 nonprofit organization. We do not charge a subscription fee, lock our news behind a paywall, or clutter our website with ads. We make our news on climate and the environment freely available to you and anyone who wants it.

That’s not all. We also share our news for free with scores of other media organizations around the country. Many of them can’t afford to do environmental journalism of their own. We’ve built bureaus from coast to coast to report local stories, collaborate with local newsrooms and co-publish articles so that this vital work is shared as widely as possible.

Two of us launched ICN in 2007. Six years later we earned a Pulitzer Prize for National Reporting, and now we run the oldest and largest dedicated climate newsroom in the nation. We tell the story in all its complexity. We hold polluters accountable. We expose environmental injustice. We debunk misinformation. We scrutinize solutions and inspire action.

Donations from readers like you fund every aspect of what we do. If you don’t already, will you support our ongoing work, our reporting on the biggest crisis facing our planet, and help us reach even more readers in more places?

Please take a moment to make a tax-deductible donation. Every one of them makes a difference.

Thank you,