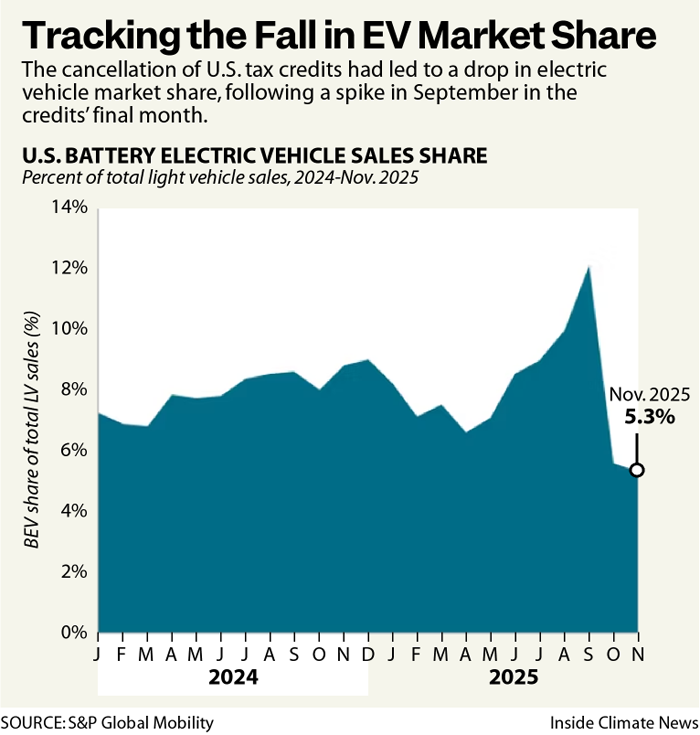

Sales of new electric vehicles have plunged since federal tax credits ended on Sept. 30.

In November, EVs accounted for 5.3 percent of U.S. new-car and light-truck sales, a share that was less than half the record high in September, according to an estimate published last week by S&P Global Mobility.

The numbers were especially ugly on Tuesday when several automakers released their November figures. Ford said that unit sales of its Mustang Mach-E were down 49 percent compared to the same month in 2024. Hyundai’s Ioniq 5 was down 59 percent. I could go on.

But most industry analysts are not sounding an alarm. This is because the decline in sales was expected the moment in July that President Donald Trump signed the legislation that canceled the credit, which was up to $7,500 per vehicle. The law led to months of chaos, during which many consumers accelerated their purchasing decisions to qualify for the credit, contributing to the collapse that followed.

One of the main questions going forward is how long it will take for the market to return to some kind of normalcy. The most common answer I’m seeing is that the current shakeout will likely last well into 2026.

After that, we’ll get to the more important question: What happens next? To help figure this out, I spoke with Peter Slowik, U.S. passenger vehicles lead for the International Council on Clean Transportation, or ICCT, a research nonprofit with offices around the globe.

“We think it’ll probably take a few quarters for the market to stabilize, but the long-term outlook, the fundamentals, the decline in costs and the increasing cost reductions that we’re seeing, all those fundamentals remain solid,” he said.

He is looking ahead to the time when a customer can buy an EV at the same price, or less, compared to a gasoline vehicle with similar features. His organization thinks that will happen across most vehicle segments by 2028 or 2029.

But there will be some milestones before then. Among them is when the total cost of ownership of an EV is the same as or lower than that of a gasoline vehicle, reflecting that an EV has lower fuel and maintenance costs. He anticipates that this will happen several years before purchase-price parity—which is right about now.

Researchers use different methods to calculate the total cost of ownership, making this a challenging metric to agree on. (Car and Driver published an overview this summer of the factors to watch.)

But there is little debate that the costs of EVs will continue to decrease, even with cuts to subsidies.

Automakers, who think in decade-plus time horizons, can see the way things are going. Each company is making strategic choices about how much to maintain gasoline and hybrid vehicle lineups, even as they know electric drivetrains will dominate the long-term future.

“We think this transition is inevitable, and the automakers that can [best navigate] this transition are the ones that are likely to win the race,” Slowik said. “They stand to win big, both at home, in terms of their domestic manufacturing volumes, and their sales shares relative to other automakers, but then also abroad.”

ICCT is a useful resource for understanding this moment. For starters, check out a Nov. 17 blog post that offers data-backed commentary on U.S. policy.

Any attempt to make predictions carries risk. If you’d asked me a year ago, I would not have guessed that Trump would be able to pass a repeal of the EV tax credits.

The credits largely benefited U.S.-based companies such as Tesla, Ford and General Motors, helping them gain a competitive edge over models assembled in other countries that were not eligible.

It didn’t make sense to remove the tax credits—and do so with such suddenness—except for the odd political reality of this year and the way the debate in Congress was dominated by fiscal hardliners.

But the push and pull of adding or subtracting subsidies will ultimately matter less than larger factors, such as the long-term decline in battery costs and the increase in battery efficiency.

In the meantime, the rough sales numbers are going to continue. Let’s reconvene next year at this time and we’ll have a better sense of what the recovery looks like.

Other stories about the energy transition to take note of this week:

Farewell NREL. Hello NLR? Longtime readers of this newsletter know that I often rely on data and expertise from the National Renewable Energy Laboratory. Now I’m going to need to get used to calling it the National Laboratory of the Rockies, following a name change instituted by the Trump administration that I wrote about for ICN. If the name change turns out to be indicative of a shift in mission for this institution, that’s bad news for the United States and the world, according to the people I interviewed.

Low-Income Families in Illinois Are Going Electric for Free: Hundreds of families have benefited from an Illinois program that pays for home electrification, as Kari Lydersen reports for Canary Media. The initiative is part of a 2021 state energy law, and it’s run by electricity utilities. While the program is small in scale, it gives a sense of what will be needed to allow for a shift away from fossil fuels for the current housing stock.

Murdoch-Owned News Outlets Wrongly Blamed Renewable Energy for New Jersey Rate Hikes: The watchdog organization Media Matters analyzed how news outlets owned by Rupert Murdoch went to great lengths to blame renewable energy for high electricity prices in New Jersey ahead of that state’s gubernatorial election. This scapegoating of renewables overlooks several larger factors, including rising electricity demand from data centers, as my colleague Rambo Talabong reports for ICN.

China Leads on Renewables and EVs: We’ve gotten used to the idea that China has become the world leader in renewable energy and electric vehicles, but the scale of that lead is so large that it’s shocking to see. Data from McKinsey shows China’s growth in market share, including 63 percent of the world’s EV sales, as Amy Harder reports for Axios.

Inside Clean Energy is ICN’s weekly bulletin of news and analysis about the energy transition. Send news tips and questions to [email protected].

About This Story

Perhaps you noticed: This story, like all the news we publish, is free to read. That’s because Inside Climate News is a 501c3 nonprofit organization. We do not charge a subscription fee, lock our news behind a paywall, or clutter our website with ads. We make our news on climate and the environment freely available to you and anyone who wants it.

That’s not all. We also share our news for free with scores of other media organizations around the country. Many of them can’t afford to do environmental journalism of their own. We’ve built bureaus from coast to coast to report local stories, collaborate with local newsrooms and co-publish articles so that this vital work is shared as widely as possible.

Two of us launched ICN in 2007. Six years later we earned a Pulitzer Prize for National Reporting, and now we run the oldest and largest dedicated climate newsroom in the nation. We tell the story in all its complexity. We hold polluters accountable. We expose environmental injustice. We debunk misinformation. We scrutinize solutions and inspire action.

Donations from readers like you fund every aspect of what we do. If you don’t already, will you support our ongoing work, our reporting on the biggest crisis facing our planet, and help us reach even more readers in more places?

Please take a moment to make a tax-deductible donation. Every one of them makes a difference.

Thank you,